[ad_1]

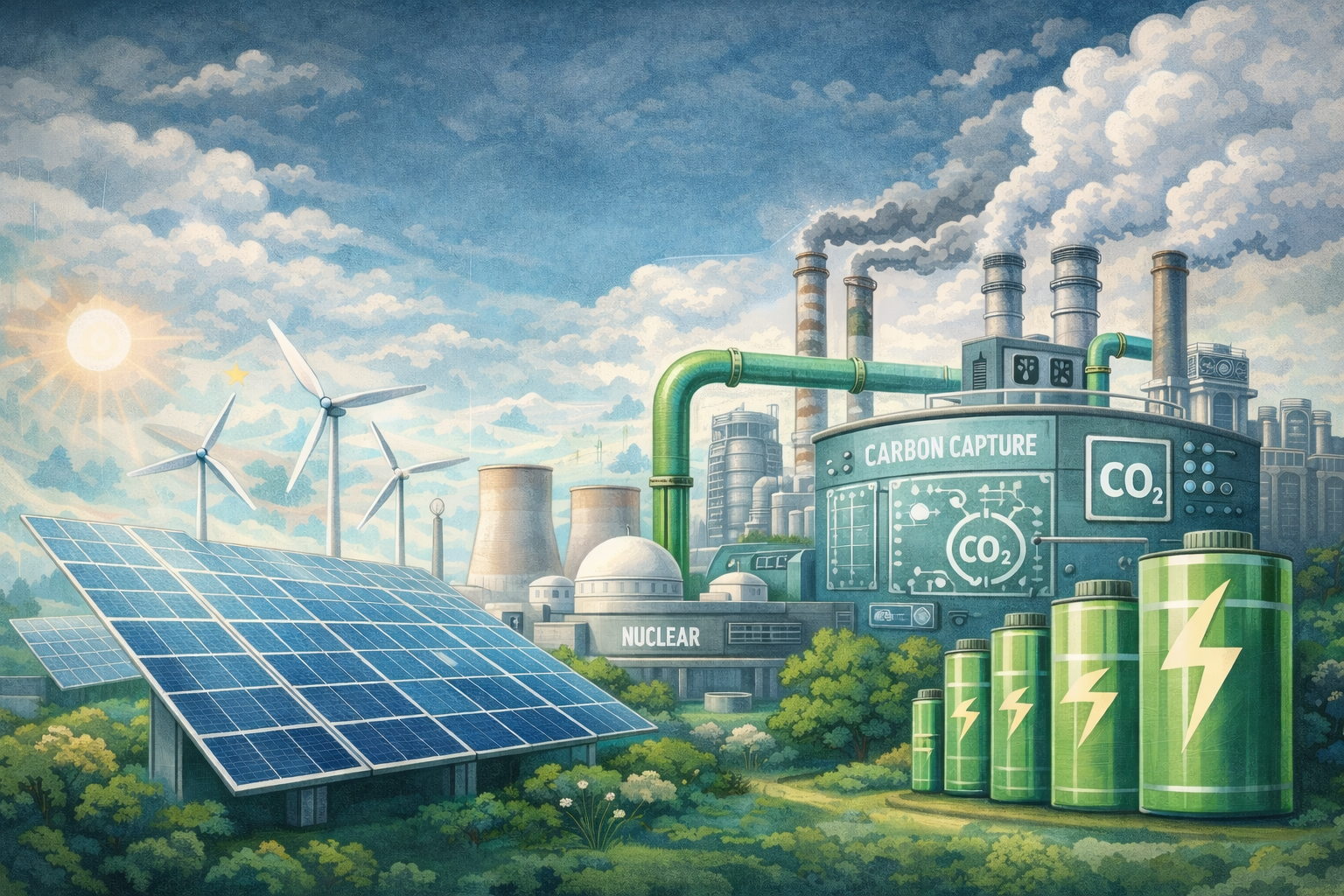

New Delhi: Finance Minister Nirmala Sitharaman in her Union Budget speech on February 1, announced an outlay of ₹20,000 crore over the next five years to support carbon capture, utilisation and storage technologies.

“Aligning with the roadmap launched in December 2025, CCUS technologies at scale will achieve higher readiness levels in end-use applications across five industrial sectors, including, power, steel, cement, refineries and chemicals. An outlay of ₹20,000 crore is proposed over the next 5 years,” she said.

The funding is aimed at scaling up projects and improving technology readiness for wider end-use applications across sectors.

According to Manish Dabkara, chairman and managing director, EKI Energy Services and President Carbon Markets Association of India, the ₹20,000 crore outlay for CCUS represents a significant transition from climate intent to execution.

“By prioritising CCUS deployment across hard-to-abate sectors such as power, steel, cement, refineries and chemicals, the government has laid the groundwork for industrial decarbonisation at scale. This is further reinforced by complementary measures supporting critical minerals, domestic manufacturing, and energy security,” he said.

The Union Budget for 2026–27 also delivered a series of customs duty exemptions and fiscal measures aimed at strengthening domestic manufacturing across energy storage, solar, nuclear power and critical minerals.

FM proposed extending the basic customs duty exemption currently available on capital goods used for manufacturing lithium-ion cells for batteries to also cover capital goods used for manufacturing lithium-ion cells for energy storage systems.

“I propose to extend the basic customs duty exemption currently available on capital goods used for manufacturing lithium-ion cells for batteries to also cover capital goods used for manufacturing lithium-ion cells for energy storage systems,” she said.

She also proposed to extend the basic customs duty exemption on the import of sodium antimonate for use in the manufacture of solar glass.

“To support nuclear power, I propose to extend the existing customs duty exemption on the import of goods required for nuclear power projects till the year 2035. This exemption will also be expanded to cover all nuclear power plants, irrespective of their capacity,” she said.

In a further boost to domestic processing capabilities, Sitharaman proposed a basic customs duty exemption on the import of capital goods required for processing critical minerals in India.

The Budget also offered relief for cleaner fuels, with Sitharaman proposing to exclude the entire value of biogas while calculating the central excise duty payable on biogas-blended compressed natural gas (CNG), a move aimed at improving the economics of blending biogas with conventional gas.

“In the case of biogas-blended CNG, I propose to exclude the entire value of biogas while calculating the central excise duty payable on biogas-blended CNG,” she said.

In order to achieve scale and improve efficiency in the public sector NBFCs, FM Sitharaman proposed to restructure the Power Finance Corporation and Rural Electrification Corporation.

She also proposed to support the mineral-rich states of Odisha, Kerala, Andhra Pradesh and Tamil Nadu to establish dedicated Rare Earth Corridors to promote mining, processing, research and manufacturing. A scheme for rare earth permanent magnets scheme was launched in November 2025.

Anujesh Dwivedi, partner, Deloitte India, said that the Budget’s proposals signal a sharper push to mobilise capital and localise supply chains for the energy transition.

“The proposed restructuring of PFC and REC is aimed at readying them for the larger electricity-sector investments needed to support GDP growth alongside transition goals. BCD exemptions reinforce the focus on scaling domestic clean-tech equipment. Extending BCD exemption on goods required for nuclear power plants until 2035 should improve near-to-medium-term project competitiveness,” he said.

He added that the ₹20,000 crore, five-year outlay for CCUS will accelerate decarbonisation and help protect export competitiveness amid CBAM. While support for mineral-rich states to build rare-earth corridors will reduce import dependence for solar cells and lithium-ion batteries.

[ad_2]

Source link